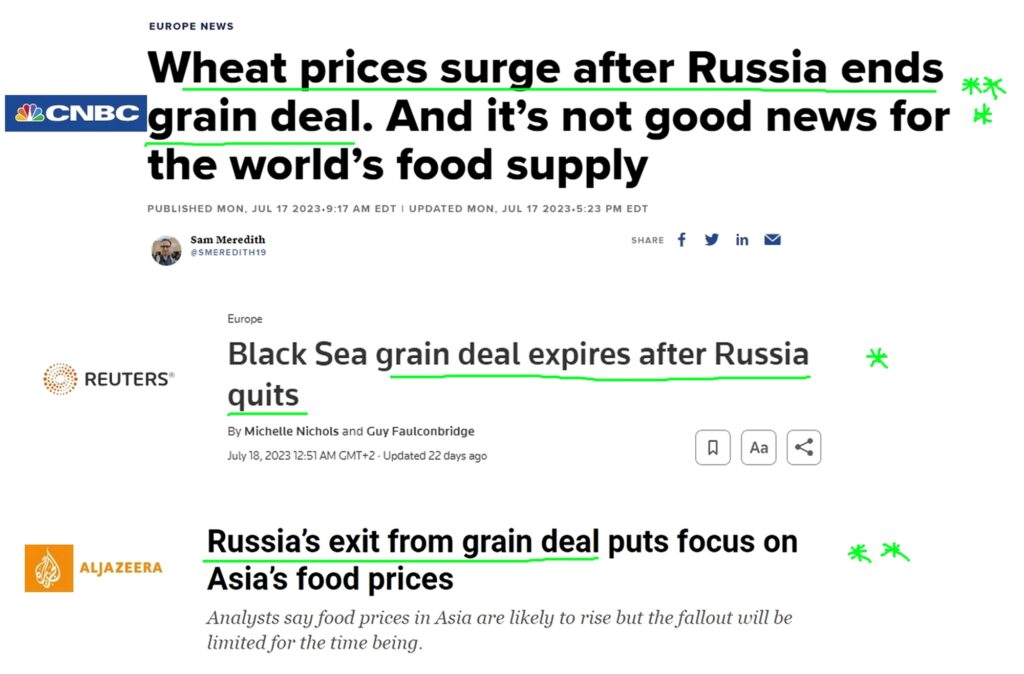

Russia’s exit from the black sea grain initiative has sparked a whole lot of reactions amidst the commodity market community. The deal intended to provide a safe passage of grain from Ukrainian ports to countries in need.

A deal brokered in Istanbul on July 22, 2022, between Ukraine, Russia, Turkey, and the United Nations to keep in place the outflow of grain commodities from the region has now suffered a serious blow. Russia announced that it pulled out from the deal on July 17, 2023, endangering so many nations’ food supply and no doubt shooting up grain and foodstuffs prices.

This new development will, in no certain terms, put the lives of millions of people worldwide at risk. Regions such as Asia, Africa, and Western Europe depend on supply from these ports. Even though some countries are better equipped than others to weather the storm, it’s no small feat to cater for such a blow of this magnitude.

The withdrawal has been labeled as a threat to civilian lives by Ukrainian Foreign Minister Dmytro Kuleba, leaving many nations, particularly in Asia and Africa, vulnerable to famine.

“By withdrawing from the grain agreement, Russia endangered the lives of millions of people around the world, primarily in Asia and Africa,” Kuleba told Al Jazeera, adding that the incident will very much likely result in a price increase of around 20 percent for commodities such as wheat, corn, and other related goods.

“After the announcement of Russia’s withdrawal from the agreement, the prices will likely go up, affecting the livelihood of millions of people across the globe, including Asia,” Kuleba said.

Moscow’s stance on terminating the deal suggests they will only reconsider returning to the table if restrictions on their grain and fertilizer exports are removed. It comes as no surprise that the United Nations has withdrawn support for the pact that could facilitate the removal of such restrictions – a move confirmed by the U.N. Secretary-General Antonio Guterres.

The Russians accused the Ukrainians of “carrying out attacks and provocations on civilians and military objects” under the guise of shipment movements, albeit without proof. However, Ukraine believes that Moscow is blackmailing the world with its actions. Russia also cited obstacles to its own shipments and a bias toward Western interests as reasons for discontinuing the pact, though the nation is the world’s top wheat shipper.

“Russia is blackmailing the world,” Ukraine’s Foreign Minister Dmytro Kuleba told the council. “This blackmail affects the lives of millions of Ukrainians and tens of millions more around the world, primarily in Africa and Asia, who face the threat of rising food prices and hunger.”

Meanwhile, with over 32 million tons of grain exported since last year that has now been halted, the U.S. press secretary on Thursday, July 27, stressed how Russia’s exit had sparked massive price volatility. “Russia’s actions to take such a significant amount of food products off the world markets will exacerbate hunger in some of the hardest-hit areas of the world, including Africa,” she said.

Wheat, Corn, and Soybeans have all risen in price on the back of this news. Fears and concerns around global food security have been reignited, with several quarters describing it as a massive blow to the market and an inexcusable setback.

Wheat rose to 689.35 per bushel at the break of the news and now trades at 704. Soybean price grew to 1388.54, while Corn went as high as 526.5 cents per bushel.

Experts on the field reported that the weather over major US corn-growing areas also features additional wetness in the next couple of weeks, adding to the “already beneficial precipitation” this year.

The abrupt end of this deal means only one thing – upward pressure on grain and foodstuffs prices. Nations in Northern Africa and Asia will mostly feel the impact as time passes. To combat the situation, Ukraine is seeking new ways to get their exports out, such as road networks, which will significantly drive up prices in the future. “Ukraine will now be forced to export most of its grains and oilseeds through its land borders and Danube ports, Head of agricultural commodities markets at Dutch lender Rabobank, Carlos Mera, said.