In less than four months, the Dutch government will reportedly shut down the Groningen natural gas field – Europe’s biggest. This move will by no means cut short Europe’s gas expectation as the winter months draw near. A Dutch government spokesperson says the field is set for closure on October 1st, a date brought far forward than the initial closure timetable. The decision to close the field comes in the wake of political pressures due to the effects of the several earthquakes caused in the Groningen area. Mark Rutte, the Dutch Prime Minister, suffered a near no-vote of confidence following accusations the government turned a deaf ear to the people’s complaints.

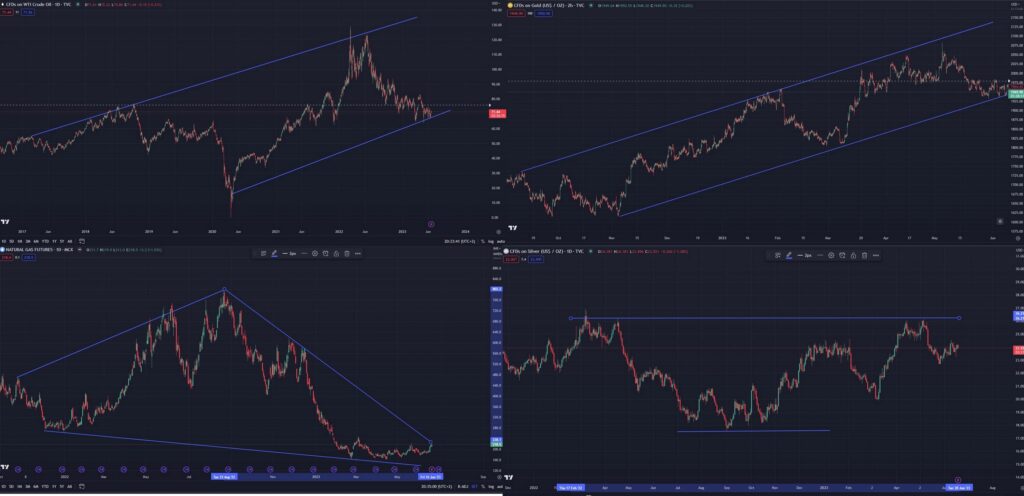

The Fed’s hawkish pause in response to the FOMC might seem to bode well for Gold, but there hasn’t been a noticeable price increase. The year has already seen ten consecutive interest rates striking blows at the precious metal. Even though the FOMC decided against the 11th one, it remains to be seen if there might still be two more on the way before the end of the year. There is no significant change because the US central bank has decided to take a pragmatic approach by waiting a little longer before increasing the Federal funds rate.

It’s no surprise that Silver has taken a similar path, with its price hanging by a thread. However, even though the permabulls are less than enthusiastic, constant demand drives inflation. The Fed will continue to get backed into a corner as inflation rises. It’s only a matter of time. The money is out there (close to $3.89 trillion from several accounts), and consumers are willing to spend – a major concern for the Feds.

Saudi Arabia (a leading member of the OPEC+) pledged to cut its oil production by a million in July following a similar reduction made by the rest of the OPEC in April. Although oil prices soared to as high as $130 at the beginning of Russia’s invasion of Ukraine, prices are now a little above $70. All efforts by Saudi Arabia and the rest of OPEC+ point to raising prices back up to above $80. It comes as no surprise that the Western Asia country is rooting for a spike in oil prices as it tries to raise funds to mitigate import bills and offset government expenditure.

According to OPEC, China is set to increase its oil demand in the coming months following the ongoing recovery from the tight restriction of the lockdown. This, coupled with the 2023 global economic growth forecast at 2.6%, all signs point to a slightly promising and upward turn. This expected increase in Brent oil price somewhat hinges on the US keeping up its first half-of-the-year momentum.

As the Energy Information Administration (EIA) reported on Wednesday (June 14th), US crude oil inventory rose beyond expectation. This surprise large build follows “strong refinery runs,” says lead oil analyst at Kpler, Matt Smith. Data indicates that the delivery hub at Cushing, Oklahoma, has experienced consecutive gains for eight weeks.

Sources:

- Dutch Government Set to Close Europe’s Biggest Gas Field in Groningen This Year – Bloomberg

- Silver Hangs on by a Thread | investing.com

- Gold Prices Slide Again Thanks To Fed’s Hawkish Pause

- Fed holds off on rate hike, but says two more are coming later this year

- OPEC: What is it and what is happening to oil prices? – BBC News

- OPEC holds oil demand view steady despite economic growth warning | Reuters

- US crude inventories post surprise large build, fuel stocks rise, EIA says | Reuters